With current gas-powered vehicles polluting the environment, now it’s the ideal time to get an electric car. While some of them can be expensive, the truth is that we have the Electric Vehicle Tax Credits that we can use to lower the price quite a bit. With that in mind, those tax credits are actually going to help you spend your money wisely, while still investing in the future.

How much credit do you get?

The 7500 tax credit is, as the name suggests, bringing you a flat up to $7500 credit. But that means you get a tax credit at that level only if the tax bill is $7500 or more. Basically, the amount of income tax you pay will limit your credit. That means you will always know how much tax credit you get, and it will help you make the right decisions as well. It’s a great opportunity and one to keep in mind if you want to buy an electric car at this particular time.

How Does the Electric Car Tax Credit Work?

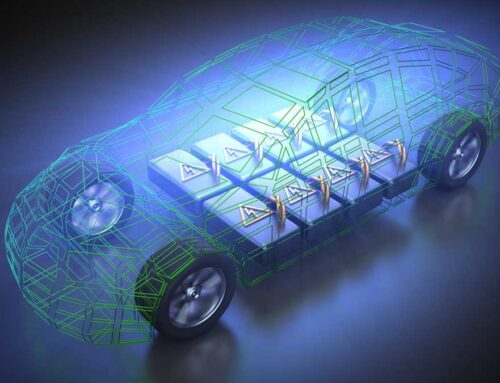

The Electric Car Tax Credit doesn’t have to do with the performance, price or range of the car. What it does focus on is the capacity of the battery pack. That’s why more expensive electric cars have the same tax credit when compared to the affordable ones. And as we mentioned above, you can only get tax credit based on how much tax liability you have.

A lot of people believe that this is a federal rebate, that’s not the case. What this does is it offers you a tax credit that lowers the tax liability on your income. Yes, eventually you spend less on taxes, but that doesn’t mean you are spending less on the car. You spend the same amount, but you save money on taxes in the end.

This Electric Car Tax Credit is offered only to the road going vehicles that are charged from an external source. You must have battery packs of 4 kWh or better. If you have a hybrid vehicle, you can’t get the Electric Car Tax Credit. That means only fully electric vehicles get the credit.

Which Electric Cars Are Still Eligible for the$7500 Federal Tax?

Right now, the list includes multiple cars like the:

These are the vehicles you can get the $7500 Federal Tax for at this time. You do need to fill out the IRS form 8936 in order to claim up your credit. As we mentioned, the credit value will vary, so it’s very important to assess how much you need to give back in taxes, as that’s how much credit you can get if it’s under $7500.

Conclusion

The $7500 Federal Tax credit is very helpful, since it can help you save a bit of money. As expected, only certain vehicles get the credit, and only if they surpass certain requirements. But it’s still amazing to see all the benefits, and the overall results are pretty impressive nevertheless. That’s why you should make the most out of this $7500 Federal Tax credit and access it right away!

Leave A Comment